Saturday, November 25, 2017

Best Life Insurance Policy to Buy

Posted by

Unknown,

on

8:33 AM

Choosing the best life insurance for your circumstance can dismay. With so much clashing data, this article will go over the distinctions so you will be better educated and can pick the correct approach.

Many individuals abstain from putting resources into disaster protection essentially on the grounds that they envision the expenses as being too high for their financial plans. Luckily, there is a wide assortment of protection arrangements accessible for each arrangement of requirements and spending plans. A lot of organizations will give you a moment term life insurance cite on their site for nothing. Protection suppliers give demise advantage payouts extending from as meager as a couple of thousand dollars as far as possible up to a couple of million. Most suppliers offer more moderate term extra security approaches—term strategies have low premiums and payout passing advantages for the span of a particular period.

If cheap life insurance with low premiums isn't a need, the lion's share of disaster protection suppliers highlights scope designs that collect money esteem over the life of the arrangement. With worldwide, the general and entire protection it is conceivable to design lucrative arrangement for assistance that payout passing advantages and can be gotten the money for out or obtained against like value.

What to Look for in a Life Insurance Policy

Policy Benefits

All protection approaches are unique. We assessed protection suppliers to a great extent on the assortment and adaptability of the life insurance arrangements they offer. From five-year term life insurance to variable general arrangements, our driving picks for life insurance suppliers give far-reaching scope to each arrangement of requirements.

Estimating and Premiums

Premium installments will be distinctive with various suppliers relying upon hazard factors, for example, your wellbeing, way of life, age and occupation. When all is said in done, protection suppliers accepting a high score on our site gave more lucrative term extra security rates than contenders paying little mind to age or way of life.

Extra Services

Disaster protection is an unquestionable requirement, yet there are numerous different administrations we hope to see accessible notwithstanding, or as another option too, life insurance. Annuities, retirement arranging, domain arranging, common subsidizes and plans custom fitted for a private company are administrations we anticipate from the best suppliers.

Client Support

Formality and poor client benefit are the last things a lamenting relative needs to manage. Our best picks for life insurance supplier brag superb client benefit, approach guarantees in an opportune and expert way and make a special effort to meet client desires.

The Best Life Insurance Policies?

Term Life Insurance

Term life insurance is regularly the best strategy for most Americans since it enables you to have the most measure of scope at the least cost. The absolute most candid supporters for term life are the prominent monetary consultants you see on TV; Susie Orman, Dave Rasmey and Clark Howard. The procedure with term extra security is to purchase term and contribute the rest yourself. A great many people have their real commitments for a specific timeframe 10-30 years. After a specific timeframe, for the most part, the home loan is paid down or paid off, the youngsters are developed and your future wage won't should be secured in an indistinguishable limit from it does today. Term extra security will be the best arrangement if this portrays your circumstance.

Term life insurance goes on for an assigned timeframe. The term time frame for most organizations extend from 10, 15, 20, and 30 years and the rates don't change amid this time. Likewise, there is no punishment for crossing out the approach early.

Whole Life-Universal Life

Entire disaster protection is a strategy that remaining parts as a result of the arrangement holder's whole life. As a rule, the arrangement will stay dynamic as long as the proprietor keeps on paying the approach premiums. Because of the cost, this sort of approach is more ideal for domain arranging and for different cases where the perpetual scope is required.

No-Exam Life Insurance

Life insurance that does not require a wellbeing exam will cost you significantly more than if you did the exam. This sort of approach is perfect for somebody who doesn't have room schedule-wise to do the restorative exam and wouldn't fret paying the additional premiums. These customers regularly require a strategy in a rush to cover a divorced person pronouncement or they might be stressed overdoing the physical. Likewise, don't mix up no-exam life coverage for no-guaranteeing. The endorsing on a no-exam strategy is exceptionally strict and not as positive as though you did the wellbeing exam.

Accidental Death

Unintentional demise strategies just pay out the passing advantage you in the event that you pass on as the aftereffect of a mishap. Run of the mill characterizations of mishaps incorporate however are not constrained to car crashes, poisonings falls, fires and chocking. Passings from normal causes, for example, coronary illness, tumor, and seniority are not secured under a coincidental demise approach. This sort of strategy is great on the off chance that you are voyaging, have a hazardous occupation, and have therapeutic issues that will avoid you from getting customary life coverage. It's normally less expensive than term life since the approach just covers unplanned passings.

Wrap Up

Since life insurance will be a standout amongst the most critical money related buys you ever make to ensure your friends and family, picking the correct approach is central. Try not to give an overeager operator a chance to talk you into purchasing an arrangement that you don't require to make sure he can get a bigger commission. Work with an accomplished specialist that will have you and your family's best enthusiasm on the most fundamental level.

Saturday, February 20, 2016

Life insurance: Purpose and conditions

Posted by

Unknown,

on

9:12 AM

For life insurance is commonly known to those contracts that guarantee, primarily, the payment of an amount after the death of a person. Technically called life insurance risk to differentiate life savings insurance, which guarantee capital or survival of the insured income (pensions, etc.).

The main purpose of life insurance is to offset the reduction in income that can produce some circumstances affecting the life of a person such as death, disability, etc. Thus they are protected dependent people insured in case of death from any cause thereof and the claims are intended to cover all or part of the income lost by this circumstance. These revenues are what allow affected families to meet its financial obligations.

The capital to be hiring depend on the needs and financial circumstances of each insured, that it must first analyzing their real needs.

The main reasons to hire a life insurance policy are to protect the spouse, partner and children, it is a way to ensure the economic, continuation of studies or deal with payment obligations such as mortgages and loans, by paying a premium affordable.

To choose life insurance that best suits our needs, it is advisable to seek the advice of a professional to help us choose the form and coverage that best suit the personal circumstances of each, if the professional is a insurance broker, plus we provide an objective product analysis of various insurance companies, giving us criteria such as the solvency of the insurer or the level of service of each of them and their fee structure, all these factors are very important as they affecting both as to its price level for the provision of the policy, for instance, there are insurance companies apply surcharges life insurance for certain professions, sports or simply driving motorcycles, an insurance broker knows these premises and we will offer the options that best fit our profile, based on criteria of quality / price.

In calculating the premium of life insurance companies take into account the different variables, the most important, age, occupation and health status of the insured at the time of recruitment.

Insurers often apply, according to the capital to hire and age of the insured, a health questionnaire and / or a prior medical examination to ascertain the state of health of the insured, lifestyle, disease history, etc.

It is very important that the health questionnaire truthfully fill since it depends on the validity of the policy.

The types of life insurance are most traded temporary assurance and specifically the following ways:

- Term life insurance annual renovable.- The contract is renewed annually, increasing the premium according to age every year for a fixed time frame ranging from the trade date until the insured has a particular age, ranging from 65 and 80 years, depending on the insurer.

- Life insurance operations linked to financieras.- Better known as safe amortization loans or mortgage insurance because they are intended to compensate capital or an income equal to the outstanding loan amortization. Year after year it will reduce the sum insured in the same proportion as the amortization of the loan.

There is also a type of insurance called "whole life insurance" has the distinction of coverage that lasts throughout the life of the insured. This type of life insurance is aimed usually people they depend on children or relatives with serious or major asset owners that wish to provide liquidity to their heirs to meet the costs of an inheritance disabilities.

Friday, February 12, 2016

No Medical Life Insurance Quotes

Posted by

Unknown,

on

10:35 PM

No Medical Life Insurance Quotes Are a Great Idea right? Possibly…

Why might you need no medicinal extra security cites?

For a few customers; they might require a no medicinal strategy due to known wellbeing issues. Then again, you might be excessively occupied with, making it impossible to take a wellbeing exam for your extra security. In either case; you ought to realize that no medicinal disaster protection will be more costly; yet why?

|

| image : paydayloansbsc.ca |

No Medical Life Insurance Quotes will be more excessive than full restorative exam disaster protection on the grounds that the insurance agency is expecting more hazard. On the off chance that a customer is applying for a non-restorative approach the insurance agency is set in a position to lose more than a customer whose wellbeing conditions are known.

Setting a monster question mark about your wellbeing danger is going to do one thing; cause an insurance agency to be agonized over your wellbeing status.

What this will mean for you is that they will expand your rates to ensure they don't clean up on your strategy.

Insurance agencies are in the matter of profiting; on the off chance that they don't think they can profit on your strategy; the rates will increment.

A term life coverage medicinal exam is simple and will spare you cash. The main reason you ought to look for a non-restorative strategy is if your wellbeing is poor and you can't secure a life coverage arrangement through ordinary measures. (Application and wellbeing exam)

The best life wellbeing handicap protection quotes will dependably go to those in the best wellbeing and who utilize the premed exam gave by the insurance agency. These exams are typically allowed to the candidate and can be performed in the home or office of the guaranteed.

One other choice for No Medical Life Insurance

Bunch protection life term strategies do offer a conservative approach to get the life scope you require. You ought to contact your boss HR office to see the life coverage approaches accessible. These polices are ordinarily a gathering rate sort and needn't bother with a physical or therapeutic exam.

For the best extra security rate cites the therapeutic exam disaster protection approach performed at application will offer the best rates on stand-alone life items. On the off chance that you can secure them go this course. In the event that your wellbeing is a restricting variable, contact your manager to exploit any gathering approach they might have. You final desperate attempt ought to be the non-medicinal sort strategy.

Thursday, February 11, 2016

The Best Life Quotes Insurance

Posted by

Unknown,

on

8:03 PM

Finding the Best Life Quotes for your family or yourself can be a genuine undeniable irritation.

I know. I've needed to search for extra security myself…

I got into protection since I was worn out on individuals fearing the protection gentleman and getting exploited. Tragically, I discovered that people feared me as well, not on account of my business strategies but rather in light of the other protection operators that might have copied them.

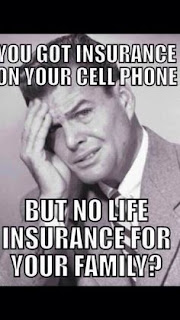

|

| image : pinterest.com |

It doesn't need to be like this

Protection is a precarious little brute. Or if nothing else it appears that way. There are such a variety of standards and laws to know.

Along these lines, whether you are searching for youngster term extra security rates or a gathering protection life term strategy for your workers. The alternatives and perplexity are about unending.

So how would you keep your head from turning right off your shoulders? In what manner would you be able to know which arrangements will be the best fit for you?

A Few straightforward keys to help you in settling on a choice:

1. On the off chance that you have no benefits and lease a loft you might need to consider an entire life arrangement. Entire disaster protection is viewed as an advantage - in spite of the fact that not a high yielding one. In any case, it can give a long haul passing advantage while additionally fabricating enthusiasm on the cash that is put into the arrangement. Any cash contributed is not lost as you can scratch off the arrangement whenever. Be that as it may, if cancelation happens the passing advantage is gone, same as whatever other life approach. It is additionally conceivable to get against an entire life arrangement and afterward pay it back throughout 12 or 24 months.

2. Else, you ought to presumably run with a Term Life Ins cite. Term disaster protection will cover you for a pre decided time span. It is the most reasonable sort of disaster protection. It permits you to cover your life amid your bread procuring years while lost life would be most harming to a crew. Term life coverage arrangements are considerably less costly than an entire life arrangement.

3. Bunch term life or gathering protection life term is a decent approach to ADD to the extra security scope you as of now have. It is not a decent remain solitary choice. The reason extra security through a business is just great as an extra is this; what happens on the off chance that you stop to be a representative of that organization? At that point what? On the off chance that 20 years pass by and you lose your employment you likewise lose your disaster protection aside from now you are 20 years more seasoned and your rates will 4 times as much. (alternately more)

4. General Life Products are an altered Whole extra security items. These can turn out to be exceptionally entangled and this article won't go into subtle element here. Essentially, on the off chance that they sound good to you they can be a decent arrangement. On the off chance that you are not happy with the clarification your specialists gives you don't go here.

Rundown – The Best Life Quotes:

Get a strategy that bodes well for you. You would prefer not to simply purchase what your loved ones are purchasing in light of the fact that their needs might be totally not the same as yo

Thursday, December 3, 2015

How to Choose a Life Insurance

Posted by

Unknown,

on

12:12 AM

How to choose a life insurance?

The truth is that life insurance is one of those things that are done in the neighbor thinking, a sign of love for family and loved ones. Selfishly speaking should not worry about what happens when we no longer are in this world, however, we want our family, we make a life insurance so that if something happens to us, they can cover the costs, pay debts and keep a standard of living much like the one they had with us. But when does it awaken in us the need to hire a life insurance? Usually at the time in which we are parents, so far, we want more out of life with us in the world. But what coverage should have life insurance? In terms of insured capital, usually, is said to be covered 10 times our annual income, however, current life insurance, are not left alone in sums insured for death or disability, if not that, at present many we offer insurance other coverage that we may be able to take advantage "in life" and we hire a little more "joy". Within this type of coverage we have encountered some as:

- Second medical opinion

- Telephone medical assistance 24 hours

- Advance of the capital in the case of terminal illness (evidently to deal with the costs that this entails)

- Legal advice service in case of death

- Of agency procedures in case of death

- Service telephone psycho-emotional support

- Tax deductions for the insured

When the life insurance contract that suits us, we must know, at least briefly, the different types of life insurance on the market:

- Term life insurance: the one in which your family receives the insurance money if you pass away while the insurance is in force.

- Life insurance or permanent life: in this case, if you die, your spouse or your family charged the death benefit. But you can also choose to extract money from the policy when you get older or you retire, and get savings with payment deferred tax.

- Disability insurance: who is charged if an inability to work is suffering?

- Mortgage life insurance: the one that guarantees the payment of your mortgage in the event of your death, your heirs freeing the payment thereof.

One of the best tools that we have to choose the most appropriate life insurance, insurance is comparators. Filling a few data we calculated a lot of life insurance with the best coverage and the best prices so that, in this way, we have a global vision of the market. Is it wise to hire a life insurance? Absolutely yes. For ourselves, as in cases of illness or incapacity we can benefit from them, and for our family, because if we let them, we know that at least we will remove them great concern over in these difficult times.

Monday, November 23, 2015

How to Save the Life Insurance Contract

Posted by

Unknown,

on

12:22 AM

One of the most difficult tasks I know is to find and hire the best insurance, either life, car, motorcycle deaths, home ...

In this post we will try to elaborate a little on how to save the life insurance contract.

The first time we plan to have a life insurance policy, we think that we are getting older, and are not always wrong this reflection. When we are young we have other things on my mind that hiring a life insurance policy, in case of bike, our first bike. But we do not stray from the subject. Statistics say that the first time we plan to hire life insurance is when we become parents. This is where we get the great deal of responsibility to our life and begin to think more of us than ourselves.

But what good is a life insurance? The truth is that it serves to secure the future (to a small extent) of your family on your MISS. But today life insurance usually have some additional coverage that the insured you can also enjoy "living" course, as second medical opinions, advancement of part of the premium for terminal illness, etc.

But what life insurance is best? At least does the best for me and my family? That is the question. Most have similar life insurance coverage, though the difference is usually in amounts sure if the cubre- disability and death.

But as always, there is so hated "fine print" that nobody reads and then we are surprised when we need to make use of the policy. To avoid shocks and unnecessary expenses, we will see some tricks or "aid" to save the life insurance contract:

To save the first rule is also important: use an insurance comparison website. Only in this way as little effort and we are able to get an idea of the products we have on the market and be able to succeed in our choice of life insurance contract.

If still having used comparator insurance do not have very clear, it is best to consult a specialist, an insurance broker for lifetime. They will find us the best choice, advise us and help us infinitely in paperwork and bureaucracy that involves hiring.

When we choose a life insurance policy, we should not only be guided by the coverage or money assures us, but it must also think that offers guarantees and tax savings and thus a way to monetize our money. Consider life insurance as a piggy bank where to put our money, which is always protected and in many cases (depending on the company) we have available if we need it.

Hire the best insurance Younger, thus you ensure an economic premium. The same goes for health, how much better health have, the less you pay, so choose a good time to hire your life your life insurance you need.

Check whether to split the payment of the premium have a charge, the company chooses not to be applied, it will be easier payment and you will save money on unnecessary charges.

Choose exclusively coverage you need, do not be "cajoled" by "added" to the policy that all they want is fat absurdly thick hedges, knowing that never will use.

To renew policies every year have the chance to change your company and thus get some sort of discount on your policy. Note that to cancel a policy must notify your company at least two months prior to the date of the end of it, and it is likely that your company will cheapen the price to get you do not take your policy to another site.

With all these tips, and we'll be ready to choose and hire the best life insurance for us and our loved ones.

Thursday, November 19, 2015

Get Your Life Insurance Comparisons

Posted by

Unknown,

on

12:31 AM

Choosing a life insurance can be an arduous and expensive task if you do not know the tools we have today.

One of the best inventions that I know is the "comparators" and specifically "insurance comparators". So before we could take hours or even days now is reduced to about 2 minutes at best.

Comparators insurance, as its name suggests, we performed a comparative life insurance, which allows us at a glance get an idea of how the market. The comparative life insurance give us the information in the format "table" which facilitates -even more- we focus on what really matters.

But what aspects we received when we get a comparative life insurance?

Usually the aspects that affect these comparisons are -monthly price or annually, usual toppings, special coverage, amortization of capital, installments and minimum receipts ... etc.

But what have you enter data for comparative my life insurance?

Usually, getting a life insurance comparison, you are only required a few minutes of our time and enter a few details such as:

DATA OF THE INSURED

Birthdate

Sex

Birthdate

Sex

RISKS INSURED

Additional risks: if you smoke or not

If you practice risk profession

Why insurance contracts: mortgage cover or family cover

CAPITAL SECURED

Capital to ensure (usually recommend 5 times your annual net income).

It makes sense that the older than the cost of insurance, and similarly if we enjoy extraordinary health costs will be lower.

In the same way our lifestyle has a significant influence on the price of the premium. This could rise to hobbies such as snuff, extreme sports or certain genetic diseases.

But are reliable data from a comparative life insurance?

Absolutely yes. Best comparators receive company information in real time, but sometimes you cannot get it, in which case we will facilitate your company so we can get in touch with them and get our price. The truth is that in these cases very little is people calling, usually stay with the data of the companies listed with them and we made a decision.

Subscribe to:

Comments

(

Atom

)